|

|

|

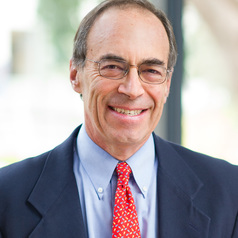

Keynote speakers > Alan J. Auerbach

Alan J. Auerbach earned his Ph.D. from Harvard University in 1978. He is Robert D. Burch Professor of Economics and Law, Chair of the Economic Department of Economics at the University of California, Berkeley, and Director of the Burch Center for Tax Policy and Public Finance. He is also a Research Associate of NBER and Vice President of the Western Economic Association International. He has been a consultant to several government agencies and institutions in the United States and abroad. He is the authors of many books dealing with taxation and, more broadly, fiscal policies. His numerous research articles have been published in diverse journals, including the most prestigious ones (American Economic Review, Journal of Economic Perspectives, Journal of Economic Literature, Quaterly Journal of Economics, Review of Economics Studies, Journal of Political Economy…). He has, or has had, editorial responsibilities in: American Economic Review, Journal of Economic Literature, Journal of Economic Perspectives, Review of Economics and Statistics… Noticeable distinctions: Professor Auerbach was Deputy Chief of Staff of the U.S. Joint Committee on Taxation in 1992. He served as an Executive Committee Member and Vice President of the American Economic Association, as Editor of that association’s Journal of Economic Perspectives and American Economic Journal: Economic Policy, and as President of the National Tax Association, from which he received the Daniel M. Holland Medal in 2011. He is currently a Fellow of the American Academy of Arts and Sciences, the Econometric Society, and the National Academy of Social Insurance. __________________________________________________ Paper "U.S. inequality, fiscal progressivity, and work disincentives: An intragenerational accounting" Abstract: This study combines the 2016 Federal Reserve Survey of Consumer Finances data and the Fiscal Analyzer, a highly detailed life-cycle consumption-smoothing program, to a) measure ultimate economic inequality – inequality in lifetime spending power – within cohorts, b) assess fiscal progressivity within cohorts, c) calculate marginal remaining lifetime net tax rates, taking into account all major federal and state tax and transfer policies, d) evaluate the ability of current income to correctly classify households as rich, middle class, and poor, e) determine whether current-year average net tax rates accurately capture actual fiscal progressivity, and f) determine whether current-year marginal tax rates on labor supply accurately capture actual remaining lifetime marginal net tax rates. We find far less inequality in spending power than in wealth or labor earnings due to the fiscal system’s high degree of progressivity. But U.S. fiscal redistribution generally comes at a price of very high work disincentives for households regardless of age and resource class. There is, however, very substantial dispersion in marginal net tax rates, which seems hard to reconcile with standard norms of optimal taxation. We also find that current income is a very poor proxy for remaining lifetime resources and that current-year net tax rates can provide a highly distorted picture of true fiscal progressivity and work disincentives. |